10 Countries Control 90% of Natural Rubber Export Value

The origins of rubber can be traced back to the indigenous peoples of Central and South America, who were the first to discover the versatile properties of latex from rubber trees. With the process of vulcanization, developed by Charles Goodyear in 1839, rubber was transformed into a more durable and elastic material, leading to its widespread commercial use. Today, rubber is a vital element in countless commercial products, from automobile tires to medical gloves. However, the contemporary global rubber industry is comparatively small, with just a handful of countries dominating its export market. According to a recent report from World’s Top Exports, ten countries collectively control 90% of the natural rubber export value, worth a remarkable $14.4 billion USD:

1. Thailand ($5.1 billion):

At the forefront of the natural rubber industry is Thailand, claiming the top spot with an export value exceeding $5 billion. The tropical climate and fertile soil in southern Thailand provide an ideal environment for rubber cultivation. Vast plantations stretch across the landscape, producing the majority of the world's natural rubber. Thai rubber is renowned for its high quality, and the country's commitment to sustainable practices ensures a steady supply to meet global demand.

2. Indonesia ($3.5 billion):

Following closely is Indonesia, contributing significantly to the world's rubber export market with an impressive $3.5 billion in value. The archipelago nation's rubber industry thrives in Sumatra and Kalimantan, where vast plantations blanket the landscape. Indonesia's commitment to increasing productivity and adopting innovative cultivation methods has cemented its position as a key player in the global rubber trade.

3. Cote d'Ivoire ($1.9 billion):

Nestled in West Africa, Cote d'Ivoire emerges as a notable player in the rubber export landscape, boasting an export value of nearly $1.9 billion. The country's rubber plantations are concentrated in the southern regions, benefitting from the tropical climate. Cote d'Ivoire's commitment to sustainable practices and community engagement sets a positive example for the industry, ensuring a harmonious balance between economic growth and environmental responsibility.

4. Vietnam ($1.3 billion):

Vietnam, with an export value close to $1.3 billion, plays a crucial role in the global rubber market. Vietnam’s rubber plantations are primarily located in the southern regions, benefitting from the favorable climate. Vietnam's strategic focus on enhancing rubber quality and adopting modern agricultural practices has led to increased productivity and a strong position in the international trade of natural rubber.

5. Malaysia ($1 billion):

Malaysia, with a rubber export value exceeding $1 billion, is a key player in the global market. The lush landscapes of peninsular Malaysia and Borneo provide an optimal environment for rubber cultivation. Malaysian rubber is highly regarded for its quality and is a major contributor to various industries. The country's commitment to research and development ensures continuous innovation in rubber production methods.

6. Laos ($0.41 billion):

Nestled between Thailand and Vietnam, Laos emerges as a significant player with an export value surpassing $400 million. The country's rubber plantations, mainly located in the southern regions, benefit from the tropical climate. Laos is rapidly gaining prominence in the rubber industry, with a focus on sustainable practices and responsible cultivation methods.

7. Cambodia ($0.4 billion):

Cambodia's contribution to the global rubber export market is substantial, with an export value of nearly $400 million. The country's rubber plantations are primarily concentrated in the eastern and northeastern regions, benefiting from the favorable climate. Cambodia's commitment to responsible and sustainable rubber production aligns with the growing global emphasis on environmentally friendly practices.

8. Belgium ($0.36 billion):

Belgium may seem like an unexpected entry in the list of top rubber-exporting countries, but it holds a significant position with an export value exceeding $366 million. The European nation acts as a key hub for rubber trade, facilitating the flow of this essential commodity to various industries across the continent. Belgium's strategic location and efficient logistics contribute to its role in the global rubber supply chain.

9. Myanmar ($0.26 billion):

Myanmar, with an export value surpassing $260 million, is making its mark in the global rubber trade. The country's rubber plantations, located in various regions, benefit from the tropical climate. Myanmar's commitment to sustainable cultivation practices and increasing productivity positions it as an emerging player in the international rubber market.

10. Guatemala ($0.21 billion):

Closing the list is Guatemala, contributing significantly to the global rubber export market with a value exceeding $200 million. The country's rubber plantations are primarily found in the northern and eastern regions, thriving in the tropical climate. Guatemala's focus on quality and sustainability enhances its standing in the competitive world of natural rubber production.

Conclusion

The natural rubber industry is firmly controlled by these ten countries, collectively responsible for 90% of the global export value. As the demand for rubber continues to rise, understanding the dynamics of these key players becomes crucial for industries relying on this versatile and essential material.

Kontango and Tratics Announce Partnership in Commodities

Kontango, Inc. (“Kontango”) and Tratics LLC (“Tratics”) are pleased to announce a partnership between our respective supply chain optimization platforms with a focus on driving value for market participants in chemicals and other underserved commodity markets.

Tratics LLC is a leading supply chain management platform for North American rail shippers and the only freight rate platform that unifies all elements of rail rates in a cloud-based platform. This partnership will allow both companies to drive higher value to our mutual customers in a critical element of their trade planning - competing in the delivered rail market for commodities.

This partnership with Tratics will enable the integration of their competitive rail rate data service with Kontango’s suite of commodity trading solutions. This collaboration will enable the development of data products and commercial planning solutions that leverage the advantages of our respective proprietary data, allowing us to deliver pioneering tools to optimize supply chains in the industry.

We are greatly excited about our partnership with Tratics and look forward to creating a meaningful impact on the business.

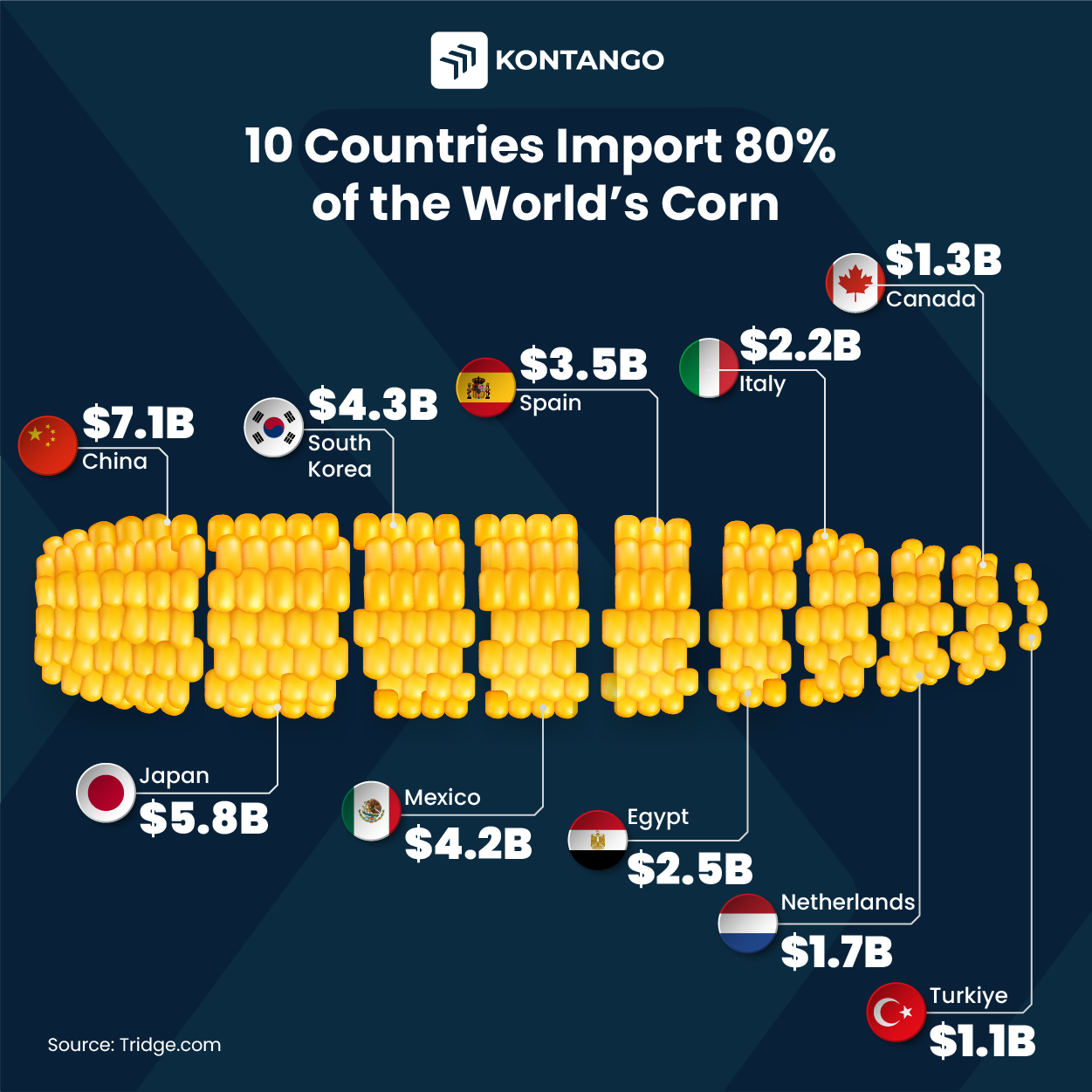

10 Countries Import 80% of the World’s Corn

Among the largest agricultural commodities in the global import market, corn is one of the most versatile, with a multitude of uses that have fueled consistent worldwide demand for decades. Corn is a staple in many diets; it is also processed into a wide spectrum of food products, including starch, sweeteners, corn oil, and beverages. Additionally, corn plays a key role in the farming industry as the main ingredient in livestock feed and for its use in ethanol production, which fuels farming equipment.

In 2023, just ten countries accounted for 80% of corn's total import value, collectively reaching a whopping $34.7 billion USD. Below is an overview of these countries and the factors that drive each nation's investment in corn.

China ($7.1 billion):

China tops the charts as the leading corn importer, with its massive livestock industry heavily dependent on corn for animal feed. This reliance is fueled by the population's increasing demand for meat and related products. The country's geographical expanse and diverse climate zones are contributing factors to China's wide array of agricultural practices, with corn playing a central role in its agribusiness.

Japan ($5.8 billion):

Ranked as the world's second-largest agricultural product importer, Japan maintains self-sufficiency in rice production but relies entirely on imports for 100% of its corn supply. Located in a region prone to natural disasters, Japan's dependence on imported corn ensures stability in its agricultural supply chain.

South Korea ($4.3 billion):

Corn serves as a crucial component in South Korea's livestock industry, supporting the production of meat products that are integral to the nation's culinary preferences. Situated on the Korean Peninsula, the country's geographical constraints and limited arable land emphasize the significance of imported corn in sustaining its agricultural needs.

Mexico ($4.2 billion):

Mexico has a longstanding relationship with corn deeply rooted in its cultural heritage. Corn is a dietary staple in Mexico, forming the basis for traditional dishes like tortillas, tamales, and more. The demand for corn transcends mere sustenance, playing a vital role in the country's cultural identity.

Spain ($3.5 billion):

Located in the Iberian Peninsula, Spain's diverse climate and large agricultural sector drive the necessity for corn imports to meet the consumer demands of its population and to support the production of animal feed for its sizable livestock industry.

Egypt ($2.5 billion):

Egypt’s limited arable land, water scarcity, and changing climate patterns have made it challenging for farmers to consistently produce sufficient corn to meet the nation's needs. The region's dry atmosphere and searing temperatures necessitate agricultural imports, and corn plays a crucial role in ensuring food security.

Italy ($2.2 billion):

Italy’s place on this list reflects a culinary tradition that heavily incorporates corn-based products. From polenta to cornmeal-based dishes, Italy's gastronomic landscape relies on corn, making it a substantial player in the global corn market. Italy's geographical diversity, including plains, hills, and coastline, contributes to a varied agriculture where imported corn complements local production.

Netherlands ($1.7 billion):

The Netherlands’ demand for corn as animal feed underscores its importance in sustaining livestock production. The country's low-lying geography and innovative agricultural practices, including extensive use of greenhouses, highlight the role of imported corn in supporting a highly efficient agribusiness.

Canada ($1.3 billion):

Canada’s corn importing highlights the grain’s role in supporting livestock farming. The country's commitment to high-quality meat production contributes to its consistent demand for corn as a key component in animal feed. The vast expanses of Canada's agricultural lands, ranging from the Prairies to the Maritimes, are indicative of the diverse ecosystems where corn is essential for livestock feed.

Turkey ($1.1 billion):

Turkey imports corn to strengthen its livestock and poultry industries while also meeting domestic consumer demands. Positioned at the crossroads of Europe and Asia, Turkey's diverse geography and climate zones influence its agricultural practices, with corn imports playing a crucial role in supporting the nation's growing food industry.

Conclusion

In 2023, ten countries collectively contributed $34.7 billion USD to corn imports, highlighting shared motivations across diverse climates. Whether driven by the need to sustain massive livestock industries, ensure agricultural stability in disaster-prone regions, or preserve cultural and culinary traditions, these nations find common ground in the versatility of corn. From meeting rising meat demands to addressing agricultural challenges like limited arable land or diverse climates, each country strategically relies on corn imports to bolster food security, support livestock sectors, and navigate the demands of a growing food industry. In essence, the global corn trade emerges as a unified response to shared challenges and opportunities in the agricultural domain.

Always in Kontango #5 • Kaylee Heap, Heap Farms

In this fifth episode of “Always in Kontango,” we had an insightful conversation with Kaylee Heap, Owner of Heap Farms. Over the last ten years Kaylee has become an expert in commodities, the movement of commodities, and technology, and has emerged as a leader in the agriculture technology space.

https://open.spotify.com/show/4M0wXNIvCDA8HB7WHtBVf0

In addition to her career in agriculture and logistics, Kaylee owns and operates a farm in Illinois, where she lives with her husband and three young sons..

Growing up in a small town with a large family that ran several small businesses, she married into farming after meeting her husband in college. Raised with an 'all hands-on deck' mindset, she attributes her ability to adapt to farm life to her childhood experiences running her family's small businesses with her siblings.

Kaylee studied accounting and finance in college, and her interest in farming started with an internship at a bank, where she eventually became an underwriter for agriculture loans. She transitioned from banking to the grain industry, working first as an originator for a co-op in Northern Illinois, and later managing their innovations team. She was introduced to the technology side of the business while trying to solve her team’s workflow issues, which sparked her enthusiasm for using technology to connect systems and solve complex problems.

Passionate about agriculture and technology, Kaylee discusses the challenges and opportunities in the grain industry, particularly in the movement of commodities. She shares her thoughts on addressing industry concerns through technology solutions and the need for collaboration within the industry to drive positive change.In this podcast episode, we explore the significant moments of Kaylee's career and her experiences working in the agriculture technology sector. Join us in this episode as we hear Kaylee’s perspectives on successfully exacting change in the industry, her excitement about seeing solutions successfully implemented, and her experience as a panelist at the Women in Agribusiness Conference.

Podcast: https://open.spotify.com/show/4M0wXNIvCDA8HB7WHtBVf0?si=46d6db8afd43421d

Always in Kontango #5: https://open.spotify.com/show/4M0wXNIvCDA8HB7WHtBVf0

In this episode: Kaylee Heap (Owner, Heap Farms), Mara Jorgenson (Head of Freight, Kontango)

Top 10 Countries Produce 84% of the World's Silver

Silver, a precious metal known for its lustrous sheen and malleability, has been a cornerstone of human civilization for millennia. Beyond its traditional uses in jewelry, coins, and decorative items, silver has become an indispensable component in various modern industries due to its outstanding electrical conductivity, thermal properties, and catalytic activity. From electronics to green technologies, the role of silver is pivotal, underscoring the significance of its global production.

Silver’s production is a significant aspect of the global economy. In 2023, the top ten countries in silver production contributed a substantial 83.62% of the world's total output, amounting to 21,740 metric tons out of the global total of 26,000 metric tons.

1. Mexico: The Silver Giant

Mexico stands as the world's largest silver producer, contributing 6,300 metric tons annually. The country's vast mineral-rich lands, particularly in regions like Zacatecas and Durango, have cemented its top position. Silver mining in Mexico is more than an economic activity; it's a part of cultural heritage, with techniques evolving from ancient methods to modern, environmentally conscious practices.

2. China: A Diverse Mining Powerhouse

China, with its 3,600 metric tons of silver production, is not only a major player due to its volume but also due to its diversified mining strategies. Chinese mines often extract silver as a by-product of other mining activities, especially in regions rich in other minerals like lead, zinc, and gold. This multifaceted approach maximizes resource utilization and contributes significantly to the global silver supply.

3. Peru: Historical Riches

In Peru, silver mining is deeply intertwined with the country's rich history. Producing 3,100 metric tons, Peruvian mines like those in the Cerro de Pasco region have been operational for centuries. The Peruvian Andes are home to some of the most extensive silver deposits, where mining is carried out with a blend of traditional knowledge and modern technology.

4. Chile: Copper's Silver Lining

Chile's silver production, amounting to 1,600 metric tons, is primarily a by-product of its world-renowned copper mining industry. The geological synergy between copper and silver deposits means that Chile's massive copper mines, like Escondida and Collahuasi, are also significant sources of silver.

5. Australia: Down Under's Silver Streak

Australia contributes 1,400 metric tons to the global silver production, heavily supported by its technologically advanced mining industry. Regions like Broken Hill and Mount Isa are not just mining towns but also landmarks in the global silver industry, reflecting Australia's commitment to resource extraction and environmental sustainability.

6. Poland: A European Leader

Poland, producing 1,300 metric tons of silver, is distinguished by its rich mining history and modern approaches. The country's significant silver deposits are often associated with lead, zinc, and copper ores, particularly in the Silesian region. Poland's integration of cutting-edge technology in mining reflects its role in shaping Europe's silver production landscape.

7. Bolivia: Tradition Meets Modernity

In Bolivia, traditional mining methods coexist with modern practices, resulting in a production of 1,300 metric tons of silver. The country's mining culture, dating back to pre-colonial times, is evident in places like Potosí, once a historic silver mining center. Today, Bolivia balances its rich mining heritage with contemporary environmental and safety standards.

8. Russia: Vast Potential Unleashed

Russia's vast and varied landscape contributes 1,200 metric tons of silver annually. The country's abundant natural resources, coupled with significant investments in mining technology, have enabled it to tap into its extensive silver deposits efficiently. Russian silver production is a testament to its geological wealth and technological prowess.

9. United States: Innovation in Mining

The United States adds 1,100 metric tons to the world's silver production. American silver mining is characterized by innovative techniques and stringent environmental regulations. Major mining states like Nevada and Alaska are home to some of the most modern and sustainable mining operations in the world.

10. Argentina: Rising Star in Silver

Argentina, with its production of 840 metric tons, is a growing force in the silver mining industry. The country's development of new mining projects and expansion of existing ones reflects its potential to become a more significant player in the global silver market..

Conclusion: A Shining Future

These countries' contributions highlight the global silver industry's geographical diversity and the role of natural resources, technological advancements, and historical mining practices in shaping the current landscape of silver production. The Silver Institute's World Silver Survey 2023 provides comprehensive insights into these trends and the overall silver supply and demand.

The global silver industry, led by these ten countries, is not just about extracting a precious metal; it's about fueling industries of the future. From solar panels and electric vehicles to medical technologies and electronics, silver's role is expanding in our increasingly technologically-driven world. The 84% contribution of these top producers underscores their critical role in meeting the world's silver demands, shaping economic landscapes, and driving technological advancements.

Top 10 Countries Control 81% of Global Tea Export Value

In a clear demonstration of market concentration, the latest data from Trademap.org reveals a significant trend in the global tea export industry. Just ten countries now command an overwhelming 81% share of the global tea export market, underscoring their dominant economic roles in this sector. This concentration of market power not only reflects the strategic economic positions of these nations but also signals shifting patterns in global trade dynamics. From China's extensive exports to the emerging prominence of countries like Kenya and Sri Lanka, the tea market offers a nuanced view of global economic interactions, shaped by a blend of historical production capacities and modern trade strategies.

1. China: The Tea Titan

Leading the pack is China, with an export value of approximately $2.08 billion. Known as the birthplace of tea, China's diverse climate and rich cultural heritage have made it a powerhouse in tea production and export. The country's vast range of teas, from green to oolong, continues to captivate the global market.

2. Kenya: Africa's Tea Jewel

Kenya follows as the second-largest exporter, with exports worth around $1.39 billion. Kenya's tea industry is a critical component of its economy, and the country is renowned for its robust, aromatic black teas, which are highly sought after worldwide.

3. Sri Lanka: An Island of Tea

Sri Lanka, an island nation, holds the third spot, exporting tea worth approximately $1.23 billion. Known for its Ceylon tea, Sri Lanka has a rich history intertwined with tea production, characterized by its unique flavors and quality.

4. India: A Blend of Tradition and Modernity

India, with a tea export value of around $751 million, is another major player in the global tea market. Home to famous varieties like Assam and Darjeeling, Indian tea is celebrated for its distinct taste and quality.

5. United Arab Emirates: The Rising Hub

The United Arab Emirates, surprisingly, ranks fifth with exports totaling about $439 million. Its strategic location and robust trading infrastructure have made it a significant hub in the tea trade, despite not being a major tea producer.

6. Poland: Europe's Tea Trader

Poland comes in sixth with tea exports valued at approximately $253 million. Poland's position highlights the country's role as an important node in the European tea distribution network.

7. Germany: The Western Tea Connoisseur

Germany, with an export value of around $229 million, stands seventh. Its strong economy and a growing tea culture have positioned it as a key player in the Western tea market.

8. Vietnam: The Quiet Competitor

Vietnam, known for its green tea, ranks eighth with exports worth about $223 million. Vietnam's tea industry has seen significant growth, driven by its focus on quality and sustainability.

9. Japan: The Land of Green Tea

Japan, with exports totaling approximately $170 million, is ninth. Japan is celebrated for its high-quality green teas, such as matcha, which have gained international acclaim.

10. United Kingdom: The Traditional Market

Finally, the United Kingdom rounds out the top ten with tea exports worth about $123 million. The UK's long-standing tea culture and history as a former hub of the global tea trade reflect its continued significance in the market.

Conclusion

The dominance of these ten countries in the global tea export market is a clear indicator of the evolving landscape of international trade and economic influence. Their combined export power, capturing 81% of the market, highlights not only their agricultural and production strengths but also their ability to navigate and shape global trade networks. This trend in the tea market, reflective of broader economic shifts, underscores the importance of understanding how traditional commodities like tea can become pivotal in the interplay of global economic forces. As the world continues to witness changes in trade dynamics, the tea industry, led by these key players, remains a critical sector to watch for insights into global market trends and economic strategies.

10 Countries Hold 99% of Global Rare Earth Reserves

Rare earth elements (REEs) are a group of 17 chemically similar metallic elements, including cerium, yttrium, and lanthanum. These elements are essential in modern technology, playing a critical role in the manufacture of various high-tech products, from smartphones and computers to electric vehicles and renewable energy technologies. The global distribution of rare earth reserves is highly uneven, with just a few countries holding the vast majority of these valuable resources.

1. China (44 Million Metric Tons): China's reserves are the largest globally. The country has been actively managing its rare earth resources, focusing on reducing illegal mining and establishing stockpiles. China's rare earths are essential for various industries, and the Bayan Obo mine in Inner Mongolia is the world’s largest rare earth element mine. Despite being the top producer, China has raised concerns about the depletion of its reserves and has been importing heavy rare earths from Myanmar.

2. Vietnam (22 Million Metric Tons): With significant reserves, Vietnam is emerging as a potential alternative to China in the rare earth market. Its production increased considerably in 2022, indicating a growing industry. Vietnam is unique in having a vertically integrated rare earth magnet supply chain outside of China.

3. Brazil (21 Million Metric Tons): Brazil, tied with Russia for third place in reserves, has been a minor producer. However, this is changing with the commissioning of the Pela Ema rare earths deposit, which will produce critical magnet rare earth elements. This development may position Brazil as a significant future player in the global rare earth market.

4. Russia (21 Million Metric Tons): Russia's reserves are substantial, and its production exceeded that of Brazil and Vietnam in 2022. The country has announced significant investments to compete in the global rare earth market, but geopolitical tensions, especially related to the Ukraine conflict, might impact its plans.

5. India (6.9 Million Metric Tons): India's reserves are primarily found in beach and sand mineral deposits. Despite its sizable reserves, India's production is relatively modest. However, the country has potential for growth in this sector.

6. Australia (4.2 Million Metric Tons): Australia has been increasingly active in the rare earth sector. With its substantial reserves, the country is well-positioned to play a significant role in the global supply chain, particularly given its stable geopolitical environment and existing mining infrastructure.

7. United States (2.3 Million Metric Tons): The U.S. has been focusing on reducing its dependency on imported rare earths. Its reserves, though smaller than the leading countries, are crucial for its strategic interests in technology and defense sectors.

8. Greenland (1.5 Million Metric Tons): Greenland's reserves have attracted global attention due to the geopolitical significance of the Arctic region. The region’s potential as a rare earth supplier is increasingly recognized. Greenland belongs to Denmark, the only major European country and member of the European Union to be one of the major players in rare earths.

9. Tanzania (890,000 Metric Tons): Tanzania's rare earth reserves, while smaller than the global leaders, hold significant potential. The country's strategic geographical location and the growing global demand for rare earth elements position it as an important player in the regional market. Tanzania's potential in the rare earth industry is closely watched by global investors and industry analysts, given the increasing importance of diversifying the global supply chain away from dominant producers like China.

10. Canada (830,000 Metric Tons): Canada's rare earth reserves are crucial for North American supply chains, especially given the country's stable political environment and established mining industry. While Canada's reserves are modest compared to global leaders, the country has been actively exploring and developing its rare earth resources. This effort is part of a broader strategy to reduce reliance on imports and to establish a more self-sufficient supply chain for critical minerals in North America. Canada's role in the global rare earth market is expected to grow, contributing to the diversity and security of the global supply of these essential elements.

The strategic importance of these ten countries in the global rare earth reserves cannot be overstated. The distribution of these reserves is pivotal not only for the high-tech and green technology sectors but also for the broader geopolitical and economic landscapes. Rare earth elements are integral to numerous modern technologies, including renewable energy systems, electric vehicles, smartphones, and advanced defense equipment. The countries holding these reserves, therefore, wield significant influence over global technological advancement and sustainable development.

The concentration of rare earth reserves in these few countries underscores the urgency for diversifying supply chains and exploring alternative sources. It highlights the potential vulnerabilities in the global market, where geopolitical tensions or supply disruptions in any of these countries can have far-reaching impacts. For instance, China's dominance in the market has raised concerns about supply security, prompting other countries to develop their own rare earth resources or seek alternative suppliers.

The environmental impact of rare earth mining and processing is a growing concern. The extraction and refining of these elements can lead to significant ecological damage if not managed responsibly. This necessitates a balance between meeting the growing demand for rare earths and ensuring sustainable and environmentally friendly practices in their extraction and processing.

As we move towards a more technology-driven and environmentally conscious world, the demand for rare earth elements is projected to soar. This will inevitably increase the strategic importance of these ten countries. It also presents an opportunity for international collaboration in research and development of more efficient recycling and substitution technologies for rare earth elements.

Top 10 Producers Control 89% of Global Barley Trade

The global barley market, a critical component of the agricultural sector, has seen significant developments in recent years. In 2023, the market attained a volume of approximately 180,139.69 thousand metric tonnes, with a projected growth rate of 6.30% between 2024 and 2032, reaching about 312,888.28 thousand metric tons by 2032. This growth is fueled by the increasing demand in the food and beverage industry, especially in beer production, and the health benefits associated with barley. Europe leads the global barley market, thanks to its conducive climate for barley cultivation and historical significance in culinary traditions. This article will delve into the top 10 barley-producing countries, which collectively control a substantial 89% of the global barley trade.

1. Australia

Export Value: $2,320,000,000

Global Export Share: 23.8%

Australia stands as the top exporter of barley, contributing 23.8% to the global export market. The country's dominance is attributed to its favorable climate and advanced agricultural practices. Australia is known for producing high-quality barley, which is primarily used for malting and brewing purposes. The recent adjustment in production and removal of China tariffs have significantly influenced the market dynamics.

2. France

Export Value: $1,830,000,000

Global Export Share: 18.8%

France, contributing 18.8% to global exports, is a key player in the European barley market. French barley is renowned for its quality, especially in malting varieties used in brewing. The country has a well-established agricultural sector with a focus on both quality and quantity, supported by its favorable climate and advanced farming techniques.

3. Argentina

Export Value: $1,160,000,000

Global Export Share: 11.9%

Argentina, holding an 11.9% share in the global market, is a significant exporter of barley, particularly to the beer industry. The country's agricultural sector benefits from its vast and fertile lands, favorable climate, and a strong focus on export-oriented crops. Argentine barley is particularly favored in international markets for its quality.

4. Germany

Export Value: $940,100,000

Global Export Share: 9.6%

Germany, with a 9.6% share of the global export market, is another key player in the European barley market. The country is known for its stringent quality standards and efficient farming practices. German barley is primarily used in the brewing industry, both domestically and internationally.

5. Canada

Export Value: $808,360,000

Global Export Share: 8.3%

Canada contributes 8.3% to the global barley exports. Canadian barley is known for its consistency and quality, making it a preferred choice for various industries, including brewing and animal feed. The country has experienced fluctuations in export volumes due to climatic variations and market conditions.

6. Romania

Export Value: $451,500,000

Global Export Share: 4.6%

Romania, holding a 4.6% share in global exports, has emerged as a significant barley producer in Eastern Europe. The country's agricultural sector has seen growth in recent years, with an emphasis on exporting high-quality barley to international markets.

7. Ukraine

Export Value: $447,050,000

Global Export Share: 4.6%

Ukraine, contributing 4.6% to global barley exports, plays a vital role in the European barley market. Despite facing challenges due to political and economic factors, Ukraine continues to be a significant exporter, particularly to the Middle East and North Africa region.

8. United Kingdom

Export Value: $309,230,000

Global Export Share: 3.2%

The United Kingdom, with a 3.2% share in the global market, is known for its high-quality barley, especially for brewing and distilling purposes. The UK's barley is distinguished by its unique flavor profiles, making it a preferred ingredient in the production of premium beers and whiskies.

9. Kazakhstan

Export Value: $216,000,000

Global Export Share: 2.2%

Kazakhstan contributes 2.2% to global barley exports. The country's vast steppes provide ideal conditions for barley cultivation, and it has been focusing on increasing its presence in the global market, particularly in Asia and neighboring countries. Kazakhstan's barley is primarily used for animal feed and brewing, with a growing emphasis on sustainable and organic farming practices.

10. Denmark

Export Value: $178,150,000

Global Export Share: 1.8%

Denmark rounds out the top ten with a 1.8% share in global barley exports. The country's barley is highly valued for its quality, especially in the European market. Denmark's agricultural sector is known for its efficiency and sustainability, with a strong focus on producing barley that meets the high standards of the brewing industry.

Conclusion

The dominance of these top ten barley-producing countries in the global market is a clear indicator of the strategic importance of this crop. Collectively controlling 89% of the global trade, these nations have not only perfected their cultivation and production techniques but also adapted to changing market dynamics and consumer preferences.

Australia, leading the pack, has demonstrated the importance of adapting to market changes, such as the shifts caused by trade disputes. France and Germany, with their focus on quality and tradition, have maintained their positions as key players in the European market. Argentina and Canada have leveraged their natural advantages to produce barley that meets global demands.

The Eastern European nations of Romania and Ukraine have shown remarkable growth, despite facing significant challenges. The United Kingdom and Denmark, with their focus on specialty barley for brewing and distilling, highlight the diversification within the industry.

Kazakhstan's emerging presence in the barley market illustrates the potential for new players to make significant contributions. This diversity in the sources of barley not only ensures a stable supply chain but also provides various options for quality and type, catering to different needs across the globe.

In conclusion, the global barley trade is a dynamic and crucial part of the world's agricultural economy. The continued dominance of these top ten countries is likely to shape the future of this market, influencing everything from beer production to animal feed. Understanding their roles and contributions is essential for anyone involved in the agricultural sector, from farmers to policymakers, as well as for consumers who benefit from the wide range of products derived from this versatile grain.

10 Countries Produce 78% of the World's Copper

Copper, a crucial metal for various industries, has seen significant global production, with ten countries contributing to 78% of the world’s supply. This article delves into the data and reasons behind the dominant roles of these countries in copper production.

Factors Driving Production

Geological factors play a crucial role, as countries like Chile and Peru are blessed with abundant copper deposits. Technological advancements and investments in mining infrastructure have also boosted production capacities in these countries. Economic policies, market demand, and international trade dynamics further influence production levels.

1. Chile: 5,200,000 Metric Tons

Chile is the world's largest copper producer, thanks to its vast copper deposits in the Atacama Desert. The country's stable political environment and well-developed mining industry have enabled it to maintain its leading position.

2. Peru: 2,200,000 Metric Tons

Peru's significant copper production is driven by its rich mineral deposits in the Andes mountains. The mining sector is a major part of Peru's economy, with copper being a primary export.

3. Democratic Republic of Congo: 2,200,000 Metric Tons

The DRC is a major player in African copper production, largely due to its substantial mineral wealth in the Copperbelt region. However, political instability and issues with mining rights often pose challenges.

4. China: 1,900,000 Metric Tons

China's production is notable as it is also the world's largest consumer of copper. Its production is fueled by both domestic demand and its role as a global manufacturing hub.

5. United States: 1,300,000 Metric Tons

The U.S. benefits from rich copper deposits, particularly in states like Arizona and Utah. Advanced mining technology and strict environmental regulations characterize its copper mining industry.

6. Russia: 1,000,000 Metric Tons

Russia's vast territory hosts significant copper reserves, particularly in Siberia and the Urals. Its copper industry is marked by large-scale operations and significant government involvement.

7. Indonesia: 920,000 Metric Tons

Indonesia's copper production is centered in the Grasberg mine, one of the world's largest gold and copper mines. The country's production is pivotal in Southeast Asia's mining sector.

8. Australia: 830,000 Metric Tons

Australia's copper production is driven by large mines in South Australia and Queensland. The country's well-established mining industry benefits from advanced technology and infrastructure.

9. Zambia: 770,000 Metric Tons

Zambia is a key copper producer in Africa, with its economy heavily reliant on mining. The Copperbelt province is central to its production, but the industry faces challenges like power shortages and fluctuating copper prices.

10. Mexico: 740,000 Metric Tons

Mexico's copper production is a part of its diverse mining industry. The country has several major copper mines, with a significant portion of its production coming from the northern states.

Environmental and Economic Implications

Copper mining and production are not without challenges. Environmental concerns, such as land degradation, water usage, and pollution, are significant issues. Moreover, the economic stability of these countries is often closely tied to copper prices, which can be volatile.

Conclusion

The global copper production scenario is a complex interplay of geology, technology, economics, and environmental considerations. The dominance of these ten countries in copper production is a testament to their natural resources and mining capabilities. As the world increasingly turns to sustainable practices, the future of copper production will likely involve balancing economic benefits with environmental responsibilities.

The Rise and Fall of Aluminum Prices: A 10-Year Analysis

Aluminum, a silvery-white, soft, non-magnetic, and ductile metal in the boron group, has seen its market prices fluctuate significantly over the last decade. This analysis examines these price changes from 2014 to 2023, exploring the factors that influenced these shifts and their implications for various industries and the global economy.

1. 2014 - Initial Stability and Growth

Price: $1,867 per million ton

The year 2014 witnessed a stable yet growing demand for aluminum, primarily driven by the automotive and aerospace industries. Prices were moderately high, reflecting a balanced market post the 2008 financial crisis.

2. 2015-2016 - Market Adjustments and Price Decline

2015 Price: $1,665; 2016 Price: $1,604

A notable decline in aluminum prices occurred in these years. The global economic slowdown, particularly in China, a major consumer of aluminum, contributed significantly to this trend. Additionally, an oversupply in the market, driven by increased production capacity, particularly in China, led to a drop in prices.

3. 2017 - Recovery and Price Increase

Price: $1,968

The aluminum market rebounded in 2017. This recovery was attributed to a surge in demand from the construction and automotive sectors. Additionally, efforts to cut overproduction, especially in China, helped in tightening the market and pushing up prices.

4. 2018 - Continued Growth

Price: $2,108

The upward trend continued in 2018, with prices reaching their peak for the decade. The increase was fueled by robust global demand, particularly for lightweight aluminum in the automotive industry, as manufacturers shifted towards more fuel-efficient vehicles.

5. 2019 - Market Correction

Price: $1,794

In 2019, aluminum prices saw a decline, a reflection of market corrections. The U.S.-China trade war played a significant role, creating uncertainties in the global trade environment and affecting the supply chain. Environmental regulations in key producing countries also led to changes in production processes, impacting supply and prices.

6. 2020 - Pandemic Impact

Price: $1,704

The COVID-19 pandemic caused a significant impact on the aluminum market. Initial lockdowns led to a decrease in demand, particularly from the automotive and construction sectors. Supply chains were disrupted, but the decrease in demand was more pronounced, leading to a drop in prices.

7. 2021 - Post-Pandemic Surge

Price: $2,437

With the gradual recovery from the pandemic, aluminum prices surged in 2021. The rebound was driven by a resurgence in demand, particularly as the automotive industry recovered. Stimulus measures by various governments to revive economies also played a role in boosting demand.

8. 2022 - Record Highs

Price: $2,705

The year 2022 saw aluminum prices reaching their decade-high. This increase was driven by a combination of factors, including supply constraints due to production cuts in response to environmental concerns and increased demand from renewable energy sectors.

9. 2023 - Stabilization

Price: $2,400

In 2023, prices showed signs of stabilization, though they remained high compared to the start of the decade. The market adjusted to the new normal post-pandemic, with demand continuing to be strong but more balanced with supply.

Supply and Demand Dynamics

The fundamental driver of aluminum pricing is the balance between supply and demand. This dynamic is influenced by the amount of aluminum produced and the market’s willingness to purchase it, involving producers, traders, speculators, and end-users.

Mining and Material Processing

Aluminum production is energy-intensive, requiring substantial electricity. The process of transforming bauxite ore into aluminum significantly impacts the overall price due to the costs of electricity, which vary based on global energy markets.

Geopolitical Events

Events like the Russian-Ukrainian conflict in 2023 have impacted aluminum prices. The geopolitical tensions, coupled with potential sanctions, have tightened the aluminum market and driven prices up. Russia, as a major aluminum producer, plays an influential role in the global aluminum supply.

Economic and Industry Trends

Global economic health and industrial production significantly influence aluminum demand. Fluctuations in automotive, aerospace, construction, and manufacturing sectors directly affect aluminum prices. Technological advancements, particularly in green energy, have also influenced demand.

International Trade and Policies

Trade agreements and government policies regulate material flow, impacting supply. Changes in trade policies, tariffs, and geopolitical events like sanctions can substantially influence aluminum prices.

Environmental Factors

Climate change and weather disturbances affect the transportation and production of aluminum. These factors contribute to the fluctuating costs of both energy for production and transportation to markets.

Conclusion

The last ten years in the aluminum market highlight the metal's sensitivity to a range of global factors, from economic trends and industry demand to geopolitical events and environmental policies. While the market has seen both highs and lows, the long-term outlook remains optimistic, especially with aluminum's growing role in clean technologies and sustainable development initiatives. Understanding these trends provides valuable insights into future market movements and the strategic positioning of aluminum in the global economy.

10 Countries Produce 85% of the World's Rice

Rice, as a staple food for billions, is not just a source of nutrition but also a vital component of the global economy. While many nations cultivate rice, a significant portion of the world’s supply is concentrated in just ten countries. These nations collectively contribute to about 84.77% of the global rice production, which stands at approximately 518.14M metric tons. Let's delve into these ten rice-producing powerhouses and their profound impact on global food supply, commodity trading, and geopolitics.

1. China – 149M Metric Tons

China, with its staggering 149M metric tons, is the world's largest rice producer. This vast production is a reflection of the country's extensive agricultural capabilities and the cultural importance of rice. China's varied climate and terrain allow for a wide range of rice varieties to be cultivated, making it a central player in the global rice market.

2. India – 132M Metric Tons

India follows closely with a production of 132M metric tons. Rice is integral to Indian culture and is a staple in the Indian diet. The nation benefits from a variety of climatic conditions and fertile soils, coupled with advancements in farming techniques, making it a key player in both domestic consumption and global rice trade.

3. Bangladesh – 36.4M Metric Tons

Producing 36.4M metric tons, Bangladesh has made remarkable strides in rice production, primarily through the adoption of high-yielding varieties and improved agricultural practices. Rice is not only a staple food but also a part of Bangladesh's cultural identity.

4. Indonesia – 34.45M Metric Tons

Indonesia's contribution of 34.45M metric tons underlines its importance in the global rice market. As a staple food for Indonesians, rice farming is crucial for the country's economy. Indonesia's tropical climate and extensive irrigation systems support its significant rice production.

5. Vietnam – 27M Metric Tons

Vietnam, producing 27M metric tons, is prominent in both domestic consumption and international export, particularly known for the quality of its rice. The Mekong Delta region, often referred to as Vietnam's 'Rice Bowl,' plays a crucial role in this production.

6. Thailand – 19.5M Metric Tons

Thailand, with its 19.5M metric tons, is famous for its high-quality jasmine rice. The country's economy benefits significantly from its rice export sector, making it a vital player in the global rice market.

7. Philippines – 12.6M Metric Tons

The Philippines produces 12.6M metric tons, striving towards self-sufficiency in rice production. Rice is central to Filipino cuisine, and the country's diverse climatic conditions support the cultivation of various rice varieties.

8. Burma (Myanmar) – 12M Metric Tons

Burma, also known as Myanmar, adds 12M metric tons to the global rice supply. The country has a rich tradition of rice cultivation and is steadily increasing its presence in the international rice market.

9. Pakistan – 9M Metric Tons

With 9M metric tons, Pakistan's rice production, particularly its aromatic basmati rice, is a key export product. This production plays a critical role in Pakistan's economy and food security.

10. Japan – 7.3M Metric Tons

Japan contributes 7.3M metric tons, deeply valuing rice in its culture and cuisine. Japanese rice, known for its premium quality, is essential in many traditional dishes.

These ten countries, producing a combined total of approximately 439.25M metric tons, hold significant influence in the global rice market. Their production capacities and agricultural policies greatly impact global rice availability and prices. In the complex world of commodity trading, these nations' export-import policies and geopolitical relations play a pivotal role. Any shifts in production, policy changes, or climatic impacts in one of these countries can have a ripple effect on the global market, influencing rice prices and availability.

As these nations navigate the challenges of balancing domestic needs with international market demands, their actions in rice production and trade policies will have far-reaching implications for global food security and economic stability. The future of the global rice supply and the dynamics of international trade relations will be shaped significantly by how these top rice-producing countries manage their resources and respond to evolving global challenges.

In conclusion, the role of these ten countries in global rice production is not just about feeding populations but also about shaping global markets and international relations. As the world continues to evolve, the importance of sustainable practices, strategic trade policies, and international cooperation will be crucial in ensuring a stable and sustainable rice supply for the future.

The 10 Countries That Hold 76% of Global Gold Reserves

Gold reserves are not just a measure of wealth but also a significant indicator of a country's economic strength and geopolitical influence. As nations navigate through the complexities of the global economy, their gold reserves often serve as a bedrock of stability and trust.

Here’s a look at the top ten countries with the largest gold reserves, showcasing their pivotal role in the global financial landscape.

United States of America – 8,133 Tonnes, $500 Billion

The United States sits atop the list with a colossal 8,133 tonnes of gold reserves valued at approximately $500 billion. This immense reserve underlines the country's financial power and its role as a global economic leader. The U.S.'s gold reserves are a key component of its monetary policy and global financial influence.

Germany – 3,353 Tonnes, $206 Billion

Germany holds the second-largest gold reserve globally, with 3,353 tonnes worth about $206 billion. Post-World War II, Germany focused on building its gold reserves as a foundation for its economic recovery and stability. Today, these reserves play a crucial part in Germany's financial health and its standing in the European Union.

Italy – 2,452 Tonnes, $151 Billion

Italy's gold reserves amount to 2,452 tonnes, valued at $151 billion, making it third in the world. Italy's central bank, Banca d'Italia, holds these reserves, reflecting the country's historic emphasis on gold as a symbol of economic resilience.

France – 2,437 Tonnes, $150 Billion

France closely follows Italy with 2,437 tonnes of gold reserves, worth approximately $150 billion. French gold reserves are a legacy of the country's long-standing economic power and its historical influence in global finance.

Russian Federation – 2,330 Tonnes, $143 Billion

The Russian Federation has accumulated 2,330 tonnes of gold, valued at $143 billion. Russia has been actively increasing its gold reserves in recent years, reflecting its strategy to reduce dependence on the U.S. dollar and strengthen its economic sovereignty.

China – 2,113 Tonnes, $130 Billion

China, with its 2,113 tonnes of gold reserves worth $130 billion, ranks sixth. The country has been steadily increasing its gold reserves, a move seen as aligning with its ambitions to internationalize the renminbi and diversify its foreign exchange holdings.

Switzerland – 1,040 Tonnes, $66 Billion

Switzerland holds 1,040 tonnes of gold, valued at $66 billion. Known for its stable and prosperous economy, Switzerland's significant gold reserves are consistent with its reputation as a global financial hub.

Japan – 846 Tonnes, $52 Billion

Japan's gold reserves stand at 846 tonnes, with a value of $52 billion. As the world's third-largest economy, Japan's gold reserves are a strategic asset, offering a buffer against economic volatility.

India – 797 Tonnes, $49 Billion

India, with 797 tonnes of gold reserves valued at $49 billion, reflects the country's traditional affinity for gold. Gold in India is not just a monetary asset but also an integral part of the cultural fabric.

Netherlands – 612 Tonnes, $38 Billion

The Netherlands holds 612 tonnes of gold, worth about $38 billion. The Dutch central bank views gold as a cornerstone of trust in the financial system, serving as a guarantee in times of financial crisis.

These ten countries, with their formidable gold reserves, play a crucial role in the global economic order. Their reserves are not merely figures on a balance sheet; they represent economic power, stability, and a measure of security against global financial uncertainties.

The strategic management of these gold reserves is vital for these nations, impacting their currency values, inflation rates, and international economic relations. For countries like the U.S. and Germany, their large gold reserves are integral to their status as financial superpowers. Similarly, for emerging economies like China and India, increasing gold holdings are part of a broader strategy to enhance their economic stature and hedge against global market fluctuations.

In summary, the top ten countries with the largest gold reserves are key players in the global financial arena. Their reserves bolster their economic standing, provide a cushion against economic shocks, and play a vital role in their respective monetary policies. As the global economy continues to evolve, the strategic importance of gold and these nations' policies regarding their reserves will remain a subject of keen interest and analysis in the world of finance and beyond.

Top 10 Countries Controlling the Global Natural Gas Supply

The energy landscape is witnessing a significant transformation as the global economy increasingly leans towards cleaner energy sources. Amidst this transition, natural gas has emerged as a critical bridge fuel, offering a lower-carbon alternative to coal and oil.

The countries that command the most substantial natural gas supplies are pivotal players in the global energy market. Here’s an overview of the top ten countries that are at the forefront of the natural gas supply.

United States of America – 187 Billion Cubic Meters

Leading the charge is the United States, with a staggering natural gas supply of 187 billion cubic meters. The country's vast shale reserves have been a game-changer, propelling it to the top of the list. The innovative use of fracking technology has unlocked huge reserves, making the U.S. not only self-sufficient but also a major exporter of natural gas.

Russia – 165.5 Billion Cubic Meters

Russia sits on the second-largest natural gas reserves globally, and its 165.5 billion cubic meters of supply is a testament to its energy superpower status. The country's state-controlled Gazprom is a heavyweight in the natural gas sector, with Europe being a significant consumer of Russian gas. The Nord Stream pipelines, despite geopolitical tensions, remain critical arteries for European energy needs.

Qatar – 134.2 Billion Cubic Meters

Qatar’s contribution to the global natural gas market cannot be overstated. With 134.2 billion cubic meters of supply, it is the world's largest exporter of liquefied natural gas (LNG). The tiny Gulf nation has used its wealth of natural gas to cement a place of influence on the global stage, transforming its economy and funding ambitious infrastructural projects.

Norway – 120.5 Billion Cubic Meters

Norway, with its 120.5 billion cubic meters of supply, is Europe's second-largest natural gas supplier and plays a crucial role in the energy security of the region. The Scandinavian country has been a reliable supplier to its neighbors and continues to explore new ways to extract natural gas from the North Sea.

Australia – 112.3 Billion Cubic Meters

Australia's 112.3 billion cubic meters of natural gas supply has seen it become a leading LNG exporter, particularly to Asian markets. The country has capitalized on its proximity to key markets and its vast offshore fields to become an energy powerhouse.

Canada – 82.1 Billion Cubic Meters

With 82.1 billion cubic meters of natural gas, Canada is a significant North American supplier. The country's abundant reserves, particularly in the western provinces, have made it a key player, with the U.S. being its primary export market.

Algeria – 49.9 Billion Cubic Meters

Algeria, with 49.9 billion cubic meters of supply, is Africa's largest natural gas producer. The country's strategic location near Europe makes it an essential supplier to the Mediterranean and beyond. Algeria has been working to expand its gas exports through pipelines and LNG.

Turkmenistan – 40.7 Billion Cubic Meters

Central Asia’s Turkmenistan, holding 40.7 billion cubic meters of natural gas, possesses the world's fourth-largest reserves. The country's Galkynysh field is one of the largest gas fields globally, though the lack of direct access to open seas for exports remains a logistical challenge.

Indonesia – 21.8 Billion Cubic Meters

Indonesia's 21.8 billion cubic meters of natural gas place it as a significant player in Southeast Asia. The archipelago has been a traditional LNG exporter, although domestic consumption has been rising steadily, influencing its export potential.

Nigeria – 19.6 Billion Cubic Meters

Rounding out the list is Nigeria, with 19.6 billion cubic meters of natural gas. Nigeria has Africa's largest gas reserves and is a key supplier of LNG. Despite facing infrastructural and regulatory challenges, the West African nation has the potential to climb higher on this list with proper management and investment.

These countries are not just abundant in natural gas; they also wield considerable influence over global energy prices and geopolitics. The U.S. and Russia, for example, are not just energy suppliers but also key players in international diplomacy, where energy often serves as a tool for influence. Qatar's diplomatic clout has risen in tandem with its gas exports, while Norway's wealth fund, built on oil and gas revenues, is an example of how such resources can fund sustainable growth.

As the world gradually transitions to renewable energy, the role of natural gas and these top supplying countries is expected to evolve. The importance of natural gas in the energy mix is likely to remain for the foreseeable future, given its role as a lower-carbon fossil fuel alternative and a reliable source of energy during peak demand times and as a backup for renewable sources.

Investments in infrastructure and technology are crucial for these nations to maintain their positions in the global market. Efficiencies in extraction, processing, and distribution, alongside innovation in exploring new gas fields, are expected to continue to play a significant part in the strategy of these countries.

Furthermore, the geopolitics of natural gas is complex and ever-changing. The reliability of supply, the diversity of routes and sources, and international relations heavily influence global gas supply dynamics. The countries that can navigate this landscape while ensuring stable and secure delivery of natural gas are likely to maintain or improve their standing in the global rankings.

In conclusion, the ten countries listed above are central to the current and future state of the global natural gas supply. Their natural reserves have become a cornerstone of their economic growth, and their strategic importance in the global energy landscape cannot be overstated. As the energy sector continues to adapt to the world's changing needs, these nations' policies, technologies, and diplomatic relations will shape not just their own futures but that of the entire planet's energy consumption patterns.

The 10 Biggest Global Cotton Producers

Cotton is a natural fiber and raw material that is an important ingredient in a number of products we use daily, from the clothes we wear to essential medical supplies. In 2023, the global cotton market reached a valuation of $42.8 Billion. But where does all this cotton come from? Let’s break down the numbers:

China • 6.7 million metric tons: This volume supports various industries, especially their textile sector, which is one of the world's largest.

India • 5.7 million metric tons: India produces and uses cotton for agriculture and textile manufacturing.

USA • 3.2 million metric tons: Cotton fields, especially in states like Texas and Mississippi, cater to both domestic and international cotton demands.

Brazil • 3.1 million metric tons: Their tropical climate offers an ideal environment for cotton farming.

Australia • 1.3 million metric tons: As primarily an export-oriented cotton producer, The country's cotton industry plays a pivotal role in its agricultural exports

Turkey • 1.1 million metric tons: Turkey's cotton is crucial for its substantial textile and clothing sector, which is a major part of its economy and export.

Pakistan • 0.8 million metric tons: Cotton in Pakistan is integral to its economy, supporting its strong textile industry which is a key export earner.

Uzbekistan • 0.7 million metric tons: Uzbekistan's cotton industry, historically known for its challenging labor conditions, is vital for its economy and is now moving towards modernization and sustainability.

Argentina • 0.2 million metric tons: Argentina's cotton production is smaller but vital for its domestic textile industry and regional trade.

Mali • 0.2 million metric tons: Mali's cotton production, while modest, is a cornerstone of its agricultural sector and provides significant rural employment and income.

Throughout the global distribution process chain, various stakeholders are involved, including customs officials, logistics companies, trade brokers, and regulatory agencies to ensure compliance with international standards. From production to consumption, the distribution involves:

• Transport from Farms: After harvesting and ginning, raw cotton is transported, often by truck, to spinning mills;

• Spinning and Production: At spinning mills, cotton fibers are spun into yarn and then woven into fabric;

• Exportation: The fabric or raw cotton is then exported worldwide, typically via container ships;

• Import, Manufacture, and Wholesale: Importers receive the shipments and distribute the cotton to manufacturers who create the final products, which are then sold to wholesalers;

• Retail: Wholesalers distribute these products to retailers, where they become available to consumers;

Cotton, the backbone of the textile industry, is a vital natural fiber with a substantial global footprint. Major producers like China, India, and the USA, along with countries like Brazil and Australia, grow large quantities to meet the world's demand. From farm to retail, cotton undergoes a journey involving transportation, spinning, exportation, and manufacturing, before arriving as the products we use every day. This complex distribution is underpinned by a network of stakeholders ensuring the cotton not only reaches the market efficiently but also adheres to increasing standards of sustainability and ethics.

Source:

https://www.mordorintelligence.com/industry-reports/cotton-market

https://www.statista.com/statistics/263055/cotton-production-worldwide-by-top-countries/

Top 10 Countries Controlling 95% of the Global Coal Supply

Coal, a black or brownish-black sedimentary rock primarily composed of carbon, has been the backbone of many nations' energy grids for generations. Coal plays a pivotal role in the global energy landscape. As of 2022, coal accounted for more than 7.4 billion tonnes of oil equivalent (Btoe) in consumption, indicating its prominent position in the energy sector.

A major segment of coal's utilization is in electricity generation. Around 38% of the world's electricity is derived from coal. In countries such as China and India, coal-fired power plants contribute approximately 65% and 70% to their total electricity outputs, respectively, underscoring its importance in these major economies.

Here's a look at the top 10 countries dominating the coal export game, collectively controlling 95% of the global coal supply.

Australia ($83.3B): Taking the top spot, Australia is an undisputed coal giant. With vast coal reserves and sophisticated mining operations, it plays a significant role in the energy grids of numerous nations, especially in the Asia-Pacific region.

Indonesia ($46.7B): Following closely is Indonesia, a nation with an abundance of coal deposits, primarily in Sumatra and Kalimantan. The archipelago's strategic location makes it an ideal export hub, catering to the growing demands of Asian economies.

Russia ($42.8B): Known for its vast natural resources, Russia's coal sector is no exception. Siberia, with its immense coal deposits, propels Russia to the third spot in global coal exports.

United States ($17.3B): While domestic coal consumption has seen a decline, the U.S. remains a leading exporter. Its strategic location allows it to cater to both European and Asian markets efficiently.

South Africa ($13B): With the Richards Bay Coal Terminal, one of the world's largest coal export terminals, South Africa has a distinct advantage in reaching global markets.

Canada ($10.8B): Canada, known for its rich mineral resources, is also a key player in the coal export sector. With its coal-rich provinces like British Columbia and Alberta, Canada supplies significant amounts to the global coal market.

Mongolia ($6.5B): Its proximity to China, the world's largest coal consumer, positions Mongolia as a significant exporter. With substantial untapped reserves, its role in the coal market is expected to grow.

Netherlands ($2.2B): An unexpected player, the Netherlands has coal exports valued at $2.2B. This might include re-exports, where coal is imported to be processed or refined before being exported again.

Mozambique ($2B): Its advantageous location along the southeastern coast of Africa, coupled with its access to key shipping routes, places Mozambique as a promising coal exporter.

Poland ($1.6B): Rounding off the list is Poland, with coal exports valued at $1.6B. As a significant coal producer in Europe, Poland plays a crucial role in supplying coal to its neighboring countries.

These top 10 countries, with their colossal coal reserves and infrastructural advantages, will likely continue to play a dominant role in the coal trade, influencing global energy markets and policies. With respect to environmental considerations, the energy sector has explored and invested in technologies to make coal combustion more efficient. One such technological approach is Carbon Capture and Storage (CCS). This technology aims to capture a significant portion of carbon dioxide emissions from fossil fuel-based electricity generation. By 2021, there were around 21 large-scale CCS facilities globally.

In parallel, the global energy sector is seeing a rise in the adoption of renewable energy sources. By 2022, renewables like wind and solar accounted for nearly 28% of global power generation. However, the reliance on coal remains pronounced in many developing nations due to its affordability and the presence of established infrastructure.

Source:

https://www.worldstopexports.com/coal-exports-country/?expand_article=1

Kontango Announces Argus Pricing Integration

Kontango is pleased to announce that users can now integrate their pricing data from Argus, a leading global provider of price assessments, business intelligence, and market data for the global energy and commodities markets. This integration will meaningfully enhance the service offering to our customers by integrating Argus' pricing indicators directly into the Kontango platform with users’ existing Argus credentials.

This seamless integration will allow joint customers to have convenient access to essential pricing data from Argus at key pricing locations, right within Kontango's interface. The new offering will integrate price assessments from Argus directly into the trading workflows of our mutual users to drive actionable trading insights.

“Argus has been a trusted and respected partner to key players in the commodity markets for over 50 years,” said Christian Callender-Easby, CEO of Kontango. “With this step, we continue our imperative of integrating key inputs from critical vendors in the commodity trading ecosystem directly into the trading processes of our users. These efforts will allow our users to meaningfully enhance efficiency and effectiveness in capturing market opportunities as they emerge.”

The newly integrated pricing data from Argus will enrich the Kontango user experience, allowing us to deliver on our mission of providing a one-stop solution for traders where they can harness comprehensive market data from all their trusted partners. We greatly look forward to deepening ties with Argus after this important step forward.

Kontango Inaugural Debut at the 2023 TFI World Fertilizer Conference

Kontango recently participated in the World Fertilizer Conference held from October 2-3, 2023, at the DC Marriott Marquis, Washington, DC. The event, organized by The Fertilizer Institute, drew industry professionals from around the globe representing all sectors of the fertilizer industry. The conference agenda spanned across a gamut of issues including the lingering after-effects of the COVID-19 pandemic, innovation in the industry, the global economy, and public policy.

The opening session featured a keynote by cybersecurity expert John Sileo. Then the focal point shifted during the TFI Board lunch where Senator Bozeman, the keynote speaker, dissected the farm bill and its implications for US agriculture. The discussion also extended to the global impacts of the war in Ukraine, Russia and Ukraine's significance in the global fertilizer, grain supply, and energy markets.

The Kontango team had a very successful inaugural outing at the conference with over 25 stakeholder interactions at all levels of the supply chain. The team showcased our platform and engaged in very productive dialog with global players in the fertilizer industry on current market dynamics and the technological barriers to trade optimization. We greatly look forward to deepening these relationships and our continued steps to serve the industry.

10 Largest Producers Contribute to 80% of Global Wheat

Wheat is a staple food that sustains populations across the globe. The production of this vital grain is concentrated among ten key players who collectively contribute to 80% of the global supply. Let’s delve into these wheat behemoths, exploring their production figures and the significance of their contribution to the global wheat market:

• 1. China (138 million metric tons): With vast arable lands and government-backed agricultural initiatives, China secures a dominant position in wheat production

• 2. European Union (135 million metric tons): Boasting diverse climatic zones and advanced agricultural practices, the EU stands as a significant player in global wheat production.

• 3. India (103 million metric tons): Benefiting from favorable climates and a rich history of wheat cultivation, India continues to be a major wheat producer.

• 4. Russia (92 million metric tons): Russia's extensive fertile lands, coupled with modern farming techniques, significantly bolster its wheat production capacity.

• 5. United States (45 million metric tons): Technological innovation and the fertile plains of the Midwest contribute to the US's substantial wheat production.

• 6. Australia (37 million metric tons): Despite its arid climate, efficient water management systems facilitate wheat farming in Australia.

• 7. Canada (34 million metric tons): The favorable climate of the Prairie Provinces supports robust wheat cultivation in Canada.

• 8. Pakistan (27 million metric tons): The fertile lands of the Indus Valley remain the heartland of wheat production in Pakistan.

• 9. Ukraine (21 million metric tons): Rich black soil and the adoption of modern farming methods enhance wheat production in Ukraine.

• 10. Turkey (17 million metric tons): Favorable climatic conditions and governmental support in agricultural modernization propel wheat production in Turkey.

The dominance of these ten entities in global wheat production underscores the world's reliance on a handful of powerful producers. Their collective effort is crucial in meeting the burgeoning global demand for wheat, showcasing the interconnectedness of our global food system. Understanding the dynamics of wheat production among these leading producers provides insights into global food security and the challenges and opportunities that lie ahead in ensuring a resilient global food supply chain.

The ongoing conflict between Ukraine and Russia has significantly impacted the global wheat supply. Both countries are crucial grain producers, with Ukraine and Russia accounting for 12% and 17% of the world's wheat exports, respectively. The war has led to a 60% drop in wheat trade and a 50% increase in wheat prices, causing severe food insecurity, especially in countries heavily dependent on wheat imports from Ukraine like Egypt, Turkey, Mongolia, Georgia, and Azerbaijan. The situation has propelled a global wheat crisis, urging other countries like the United States, China, India, Canada, Australia, France, Argentina, and Germany to increase their wheat production and exports to alleviate the crisis. The conflict-induced global wheat crisis and food insecurity can be notably alleviated if these countries increase their production by 2%-3% in 2022-2023 and some of the trade restrictions are exempted.

The recent grain export deal between Ukraine, Poland, and Lithuania is a strategic move aimed at speeding up Ukrainian grain exports to meet the demands of countries beyond Europe. Here's a detailed breakdown of the deal, its implications, and the broader context in which it was struck. The three countries have inked a pact focused on expediting Ukrainian grain exports. This deal is set to shift grain inspections from the Ukraine-Poland border to a Lithuanian port on the Baltic Sea, which is anticipated to streamline the export process. The strategic shift of inspection points to the Lithuanian port of Klaipeda is a key feature of this deal. This port will serve as the new inspection point for checking pests and plant diseases before the grains are exported by sea to various countries around the globe.

This agreement has broader implications than just expediting grain exports. It aims to alleviate tensions between Ukraine and Poland over grain prices. The backdrop of this deal is the ongoing conflict with Russia, which has disrupted Ukraine's traditional grain export routes through the Black Sea. This has forced Ukraine to rely on more expensive overland routes through Europe.

The agricultural exports scenario post this deal reveals a complex European dynamic. Farmers in nearby countries have expressed concerns about Ukrainian food products flooding their markets, which has pushed prices down, affecting their livelihoods. Following the end of a European Union embargo in mid-September, Poland, Hungary, and Slovakia announced bans on local imports of Ukrainian food, which led to Ukraine filing a complaint with the World Trade Organization.